In a two-part series devoted to single mothers, we asked various mommy bloggers and financial experts to share their unique perspective on finances and how they found ways to save.

Update: Check out Part 2 of this series here!

Check out the interviews below:

CreditGuard (CG): What is a good solution for a difficult challenge among single mothers?

Evie at Mom Solo: “I use my friends with older kids and mommy message boards to get all hand-me-down clothes! I almost never buy my son clothes; they’re all second-hand and in great condition!”

Jennifer at The Life of a Single Mom: “A huge challenge that single moms face is time. With the weight of the world on your shoulders and endless demands on your time, such as carpool, jobs, errands, household duties, homework, and so much more, the art of a good slow cooker meal is a must! Not only does cooking at home save money, but coming home to a warm meal at the end of the day can be just what you need to relieve some stress.”

Gary at The Dollar Stretcher: “Affordable housing is the biggest item in most budgets. It’s especially tough for single moms. Sharing a house with another single mother makes a much nicer house affordable to both families. They say that it can be hard for two women to share a house, but struggling to pay the rent or mortgage each month isn’t easy.”

Elena at Moms.com: “Being a single parent can be difficult but rewarding. Don’t blame yourself or spoil your child to try to make up for being a single parent. Your loved ones, friends and faith communities can be very helpful resources. Don’t regret help.”

CG: If you could offer one method or strategy of how to budget successfully, what would it be?

Katie at Moms.com: “Create a budget and stick to that budget. Don’t get into credit cards or overextend yourself. For families who are struggling to stick to a budget it sometimes helps to visually see your monthly spending money, putting that allotted amount of cash into an envelope and only using the money for your shopping and daily expenses. This is something any family can easily implement themselves.”

Gary: “Use your budget as a management tool. Compare your actual income and expenses to your plan. Where they differ significantly, find out why. Then determine if you need to adjust your budget or your spending habits. Using your budget this way can keep you from drifting into financial troubles.”

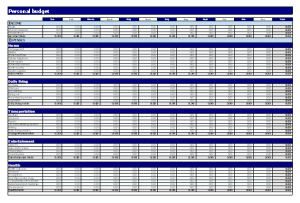

Jennifer: “Use a simple spreadsheet. They can be downloaded online for free, and there are a number of different ones to choose from. Actually, I just use a piece of notebook paper. I list every regular monthly obligation, such as rent, utilities, etc., and then what my earnings are each paycheck. As I pay my bills, I check them off each month to ensure I’m not missing anything. It allows me to best track if I have extra for a treat, such as a pedicure or a girls’ night out. If I don’t have it, I don’t spend it.”

Jennifer: “Use a simple spreadsheet. They can be downloaded online for free, and there are a number of different ones to choose from. Actually, I just use a piece of notebook paper. I list every regular monthly obligation, such as rent, utilities, etc., and then what my earnings are each paycheck. As I pay my bills, I check them off each month to ensure I’m not missing anything. It allows me to best track if I have extra for a treat, such as a pedicure or a girls’ night out. If I don’t have it, I don’t spend it.”

Evie: “I’m not sure I’m the best one to answer this because I have a lot of credit card debt. But the main thing is I never-to-rarely buy myself anything. I know how much I need to spend each month and stick to it. However, things always come up—car repairs, doctor visits… Never skimp on health. Health issues must always be addressed.”

There you have it! In addition to checking out part 2 of the series (check back here tomorrow), also have a look at our single mothers infographic on spending and budgeting.